tax consultant salary philippines

Follow these simple steps to calculate your salary after tax in Philippines using the Philippines Salary Calculator 2022 which is updated with the 202223 tax tables. Deloitte Senior Tax Consultant salaries - 1 salaries reported.

Accountant Average Salary In Philippines 2022 The Complete Guide

Tax Consulting - Salary - Get a free salary comparison based on job title skills experience and education.

. 305 salaries for 97 jobs at Deloitte in Philippines. Salaries posted anonymously by Deloitte employees in Philippines. Philippine Tax Consulting Services.

Net Salary Gross Salary - Monthly Contributions - Income Tax 25000 - 1600 - 5134 25000 - 21134 228866. Moving up the ladder a Tax Consultants annual salary is approximately 75000 while the number for a Tax Manager is 118000. Visit PayScale to research tax accountant salaries by city experience skill employer and more.

PHP 103000 mo Consultant salaries - 10 salaries reported. Visit PayScale to research tax manager salaries by city experience skill employer and more. The salary range for a tax consultant can vary greatly depending on location experience education and achieved designations.

The average salary for a Tax Manager with Tax Consulting skills in Philippines is 890073. The average income tax consultant gross salary in Philippines is 554987 or an equivalent hourly rate of 267. Thats the step by step guide on how you can compute your income tax and get your monthly net salary.

PHP 30000 mo Tax Consultant salaries - 10 salaries reported. PHP 53500 mo Tax Associate salaries - 10 salaries reported. The pay of SG 1 workers will increase to Php 12034 in 2021 Php 12517 in 2022 and Php 13000 in 2023.

In addition they earn an average bonus of 22199. The average salary for a Tax Accountant in Philippines is 398519. OR 2 Graduated income tax rates of 0 to 35 on net taxable income plus 3 percentage tax Above P250000 to P400000 20 of the excess over P250000 6430402 1286080 192912 1478992 or simply 64304023 or 123249moth.

The average salary for a Financial Consultant is 41241 per month in Philippines. VAT An independent consultant shall be subject to 12 VAT if his gross receipts exceed P1919500. 64304008 514432php tax to pay for the year.

Accurate reliable salary and compensation comparisons for Philippines. At the entry level Tax Analysts at Deloitte can make around 65000 per year. Men receive an average salary of 1200944 PHP.

The most typical earning is 357728 PHP. Enter Your Salary and the Philippines Salary Calculator will automatically produce a salary after tax illustration for you simple. Senior Consultant salaries - 11 salaries reported.

Percentage tax An independent consultant shall be required to pay the percentage tax of 3 if his gross receipts for the year do not exceed P1919500. Women receive a salary of 802333 PHP. Bureau of Labor Statistics accountants serving as tax consultants and providing tax preparation and payroll services earned an average of 85050 well above the overall average for.

Indra Consultant salaries - 12 salaries reported. According to the US. All data are based on 3080 salary surveys.

Salaries are different between men and women. Tax Associate salaries - 56 salaries reported. PHP 18000 mo.

Tax Associate salaries - 11 salaries reported. PHP 18850 mo Auditor salaries - 9 salaries reported. PwC Senior Tax Consultant salaries - 3 salaries reported.

Ii Those earning between P250000 and P400000 per year will be charged an income tax rate of 20 on the excess over P250000. PHP 25000 mo. An entry level income tax consultant 1-3 years of experience earns.

Learn about salaries benefits salary satisfaction and where you could earn the most. Having the lowest raise of 8 are those within the highest salary grade range SG 25 to 33 particularly in the executive-level positions. Senior Tax Associate salaries - 26 salaries reported.

PHP 20000 mo Auditor salaries - 9 salaries reported. In business taxes are certainties that cannot be avoided. How to calculate your salary after tax in Philippines.

Accenture Consultant salaries - 12 salaries reported. Your net-take home pay or net salary would be 228866. Doing business in the Philippines also means having to deal with various kinds of taxes in practically every aspect of your operation.

Oracle Consultant salaries - 10 salaries reported. Infor Consultant salaries - 13 salaries reported. The independent contractor may generally pass the VAT to his local clients.

PHP 18000 mo Senior Audit Associate salaries - 11 salaries reported. Salary estimates based on salary survey data collected directly from employers and anonymous employees in Philippines. I Those earning an annual salary of P250000 or below will no longer pay income tax zero income tax.

Sutherland Consultant salaries - 26 salaries reported.

Accountant Average Salary In Philippines 2022 The Complete Guide

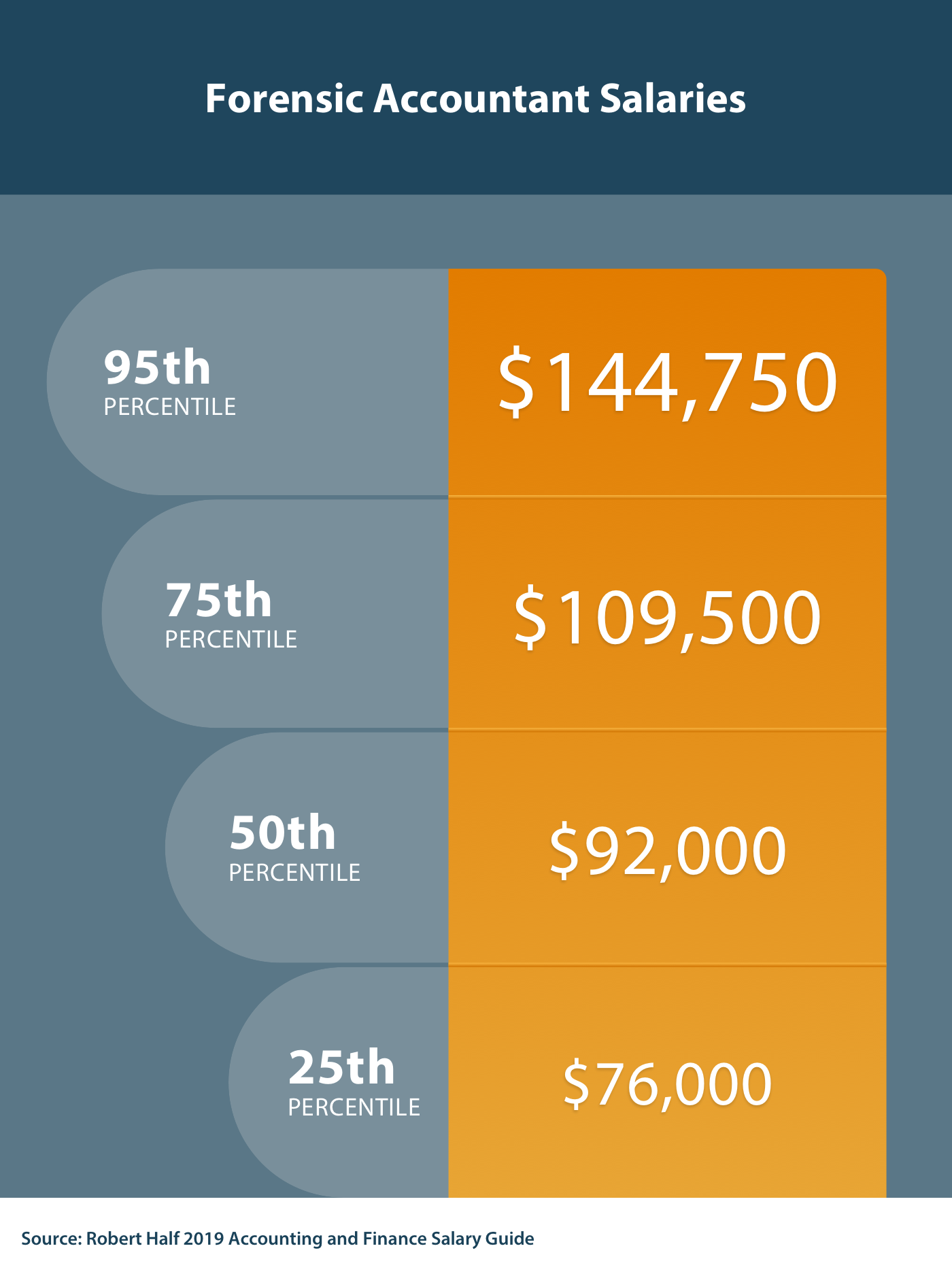

How To Become A Forensic Accountant 5 Steps To Consider

Accountant Salary Philippines Age Net Worth

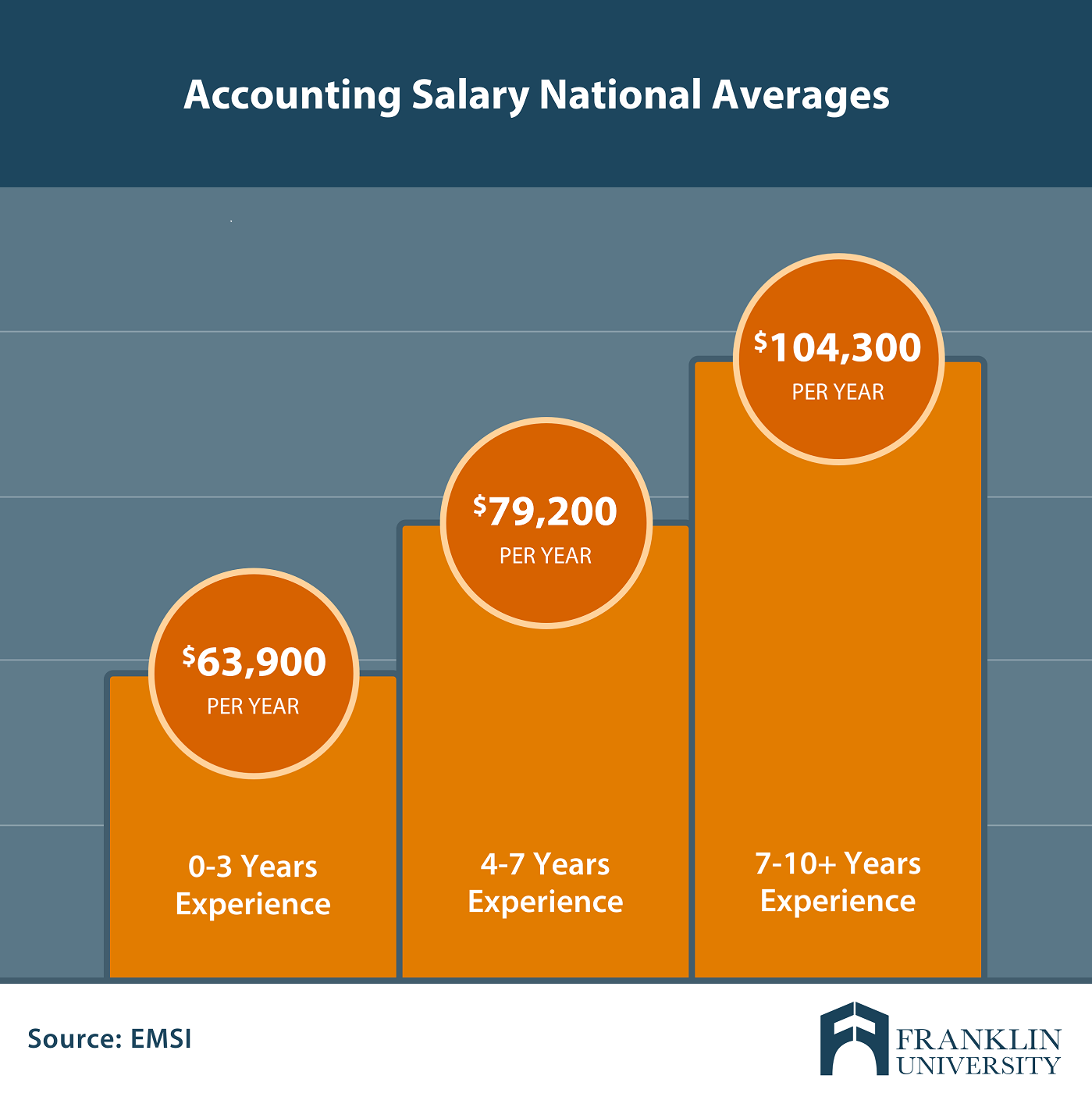

Master S Degree In Accounting Salary What Can You Expect

15 Cpa Lawyer Average Salary Philippines Average List Jobs Salary

Who Has A Higher Societal Status And Recognition In The Philippines A Cpa Or A Lawyer Attorney Quora

Accountant Average Salary In Philippines 2022 The Complete Guide

Jobstreet Com Releases Cebu Annual Salary Report Jobstreet Philippines

Accountant Average Salary In Philippines 2022 The Complete Guide